Public Investment Outlook FY 2019/20

Introduction

Over the NDP period, economic growth registered fragility. Episodes of economic downturn highlighted the economy’s vulnerability to natural and external shocks. This is highlighted by the sharp decline in economic growth from 9.4% growth in 2010/11 to 3.8% in FY 2011/12 with the continued slowdown in FY 2012/13. However the economy rebounded in the last two financial years registering 6.2% and 6.1% in FY 2017/18 and FY 2018/19[1] respectively.

The recovery is partly attributed to the continued efforts in public investments whose multiplier effects spill over to wide socio-economic productivity. The accumulated capital stock thus lays a strong foundation for private sector development since it lowers the cost of doing business, contributes to employment creation and generally improves livelihoods.

Role of public investment on economic growth

The share of investment to GDP ratio averaged 25.7%[2] over the NDP era. Of this, 3.5% is public investment compared to private investment at 22.2%. Public investments are instruments Government uses to increase production and productivity in the economy. These are complemented by a formidable human capital resource. An elaborate and functional infrastructural base promotes regional and international trade and as such improves the balance of payment and creates synergies with private sector investment.

This is because addressing constraints that impede private investments such as electricity, water, roads system cuts down the cost of doing business. Similarly, provision of key infrastructure raises Uganda’s competitiveness index and thus results in attracting more potential investors into the country. Further still, improvement in infrastructure raises standards of living among the population. The provision of safe drinking water improves health standards of the population and therefore releases funds for other basic provisions.

On account of Government’s sustained spending on economic and social infrastructure over the NDP era, socio-economic outcomes have improved. Maternal and infant mortality rates declined from 438 in 2013 to 336 in 2016 and from 53 in 2013 to 43 in 2016[3] respectively. Incidentally, out of pocket expenditure still remains high at about UGX 25,000 per capita. Similarly, education outcomes have improved with 74 percent (UNHS 2016/17) of the population being able to read and write. The challenge that remains is the ability of the economy to produce quality jobs for the growing number of graduates which requires a rethink of the job and employment policy of the country. Similarly, disparities in health and education outcomes at subnational levels exhibit significant levels of inequality. This trend has emerged despite a background of increased public spending in education and health suggesting that investment challenges go beyond financing and include provision of quality services, supervision and a right input mix.

Governments accordingly needs to strike a balance between physical and human capital developments because the current basket of investment is skewed towards infrastructure and less in the social services. Therefore whereas the investment focus is biased towards economic infrastructure, this should not undercut spending on education, health and other social services as these human needs contribute to sustainable long term growth.

Reforms in Public Investment Management

Government instituted reforms in the PIMS in 2016 to streamline project appraisal and selection. The reforms have continued to be implemented and significant achievements have been registered. Specially, project screening has been enhanced and thus improved the quality of projects that are accepted for funding.

There has been improvement in project implementation with 72% of projects being completed on time. Similarly, performance of domestically financed projects continued to improve. A total of 272[4] projects are expected to exit the public investment plan in FY 2019/20 thereby freeing up funds for critical investment priorities.

Financing Outlook

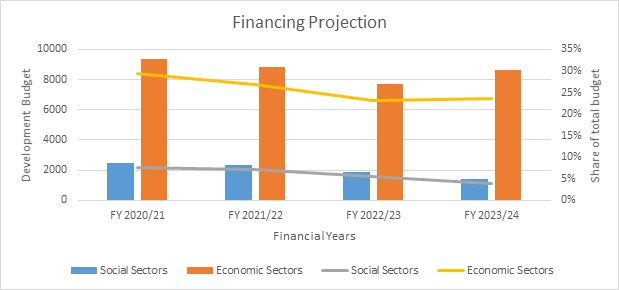

The financing projections for NDP III period indicate a sharp divergence between investment in the social sectors and the economic sectors. Investments are inclined towards infrastructure development especially in the roads and energy sectors. The trend reinforces the existing imbalance between investment in human capital and physical capital in the country. It suggests the need to pay greater attention to social services delivery.

Graph 1: Financing Public Investment projections for NDP III period

To build on the above achievements, Government will need to address the following issues:

- Adherence to the established guidelines in project selection and preparation by strengthening the screening process to enable projects sequencing and prioritisation.

- Government obligations on counterpart financing should be timely honoured including addressing land acquisition delays that impede project implementation. This should be augmented with the need to sustain the operation of created assets.

- Develop an asset register of government infrastructure that will schedule the type of maintenance and rehabilitation. This will be instrumental in identifying maintenance and rehabilitation needs of existing infrastructure.

- Balance between social investment and economic investment needs to be realised to avoid neglecting critical social investments such as health and education. Although the trade-off may seem unattainable, sequencing of infrastructure projects can free up funds for the social services.

- The limited fiscal space dictates caution while acquiring loans to finance infrastructure projects, this is will lower debt distress and place the country at a low risk of debt sustainability.

[1] UBOS publications (GDP Publications FY2018/19)

[2] Authors calculations based on rebased GDP series

[3] UBOS (2016 Uganda Demographic and Health Survey)

[4] FY 2019/20 Main Development Committee Report, MFPED